Are you thinking about investing in wine? If so, you’ve found the correct post that’s going to provide you with all the information you might need. While many people associate wine with special events or luxury dinners, it is actually a great financial opportunity. Here are some explanations for why adding wine to your investment portfolio can be a smart move:

First and foremost, wine has a track record of producing high returns. Fine wine has outperformed many other asset classes over the last three decades, according to the Liv-Ex Fine Wine 100 Index, the industry-leading benchmark that analyzes the price performance of the 100 most-traded wines in the secondary market. The index increased by more than 200% between 2005 and 2020. That’s a pretty impressive return! Also, by consulting this or any other wine index you or your wine broker prefer, you can make some relatively safe choices for investing, by viewing how prices of specific wines have changed over the years. Wine indexes are also a great way to get acquainted with the wineries that produce wines that have been proven to be ageworthy, therefore worth the investment.

If you’re generally interested in making various investments in order to diversify your portfolio and boost your income, wine is a great choice. Since it has no direct correlation to the stock market or other conventional investments, wine can be a useful tool for investor diversification. This can lower the overall risk of the portfolio while increasing returns.

You might be wondering why you should invest in wine instead of buying stocks or focusing on other conventional investments like real estate. Well, unlike stocks or bonds, wine is a physical asset that you can hold and enjoy. Furthermore, wine is also a tangible asset with a finite quantity. Since particular vintages and producers are in little supply, it’s very possible that they become more valuable over the years as demand grows and supply diminishes. Finally, because wine is a consumable asset, the quantity of a given vintage will never increase, making it an even more attractive asset.

An additional reason as to why wine makes a great investment choice is that the wine industry is worldwine. There are many regions that produce wine and each one has its own distinct profile. Due to this diversity, there are multiple opportunities to invest in different countries and producers, allowing for a well-diversified portfolio. Wine can also be traded internationally due to the wine market’s global nature, giving investors access to a more sizable and liquid market.

Wine offers a hedging method against inflation, which is another reason why you should invest in it. The value of money declines when inflation increases, which can be detrimental to many investments. But because wine’s price tends to climb along with inflation, it can act as a good inflation hedge. This is due to the fact that wine production is labor-intensive and expensive, hence the cost of production rises in line with inflation.

Additionally, investing in wine can not only provide financial benefits, but it can also promote sustainability. Investors have the opportunity to support small wineries or wineries that choose to cultivate grapes and produce wine in a “greener” way, i.e. without the help of chemicals. Many wineries rely on investment to expand and improve their operations, and investing in these wineries can help support local economies and promote environmentally friendly practices.

Last but not least, buying wine may be an interesting and joyful activity. While you might want to hold onto a wine you’ve invested in as an asset, that doesn’t mean that you can’t enjoy and share a bottle with your loved ones. Many investment-grade wines can be enjoyed even if they were bottled half a century ago, so it’s not uncommon to see Bordeaux wines from 1982, a classic vintage year, at auctions. The act of choosing and buying great wine can be enjoyable, and having a collection of fine wines can make you feel proud and satisfied.

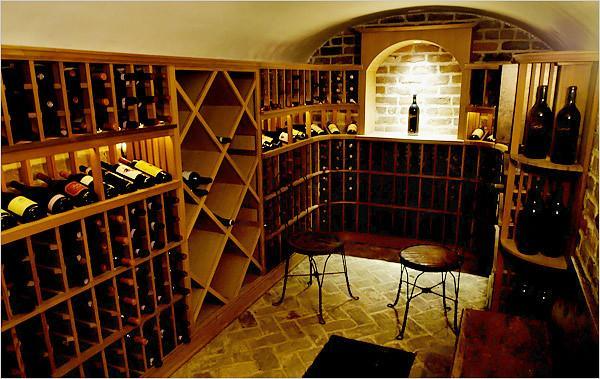

Before you start investing in wine, it’s important to invest in building, or renting, a wine cellar. Environmental factors such as exposure to light, extreme temperatures or humidity can lower the quality of a bottled wine, so it’s important to have a proper storage space for your investments.

Overall, there are a lot of good reasons to consider investing in wine. Wine can be a great addition to your financial portfolio due to its high returns and little correlation with other asset types. However, in order to make wise investment choices, it’s crucial to do your homework on the “big” names of each region, and work with a trustworthy wine broker, in order to avoid the risk of buying counterfeit wines.

Cheers to buying a tasty and successful asset!